Tại sao khách hàng tin tưởng Click Không Thuốc Lá

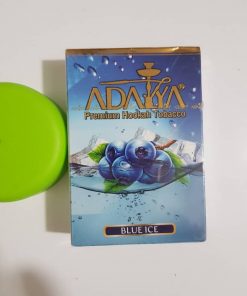

Shop Click Không Thuốc Lá là địa chỉ mua sắm lý tưởng cho những người yêu thích shisha và trải nghiệm hút thuốc lá điện tử. Chúng tôi tự hào là địa điểm cung cấp các sản phẩm shisha chất lượng, đa dạng và đáp ứng đầy đủ nhu cầu của khách hàng.

✅Cung cấpshisha chất lượng cao với nhiều hương vị từ các nhãn hiệu uy tín.

✅Dịch vụ chăm sóc khách hàng xuất sắc, giúp khách hàng chọn lựa sản phẩm phù hợp và giải đáp mọi thắc mắc.

✅Các ưu đãi đặc biệt, giảm giá, hoặc khuyến mãi thường xuyên.

✅Nhận được nhiều đánh giá tích cực và phản hồi tốt từ khách hàng

✅Chính sách giao hàng nhanh chóng và đổi trả linh hoạt, tạo điều kiện thuận lợi cho khách hàng.

KHUYẾN MÃI HÀNG NGÀYXem tất cả

40.000₫

150.000₫

-25%

150.000₫

400.000₫

1.250.000₫

-5%

950.000₫

Liên hệ: 0969.196.xxx

70.000₫

370.000₫

370.000₫

-6%

80.000₫

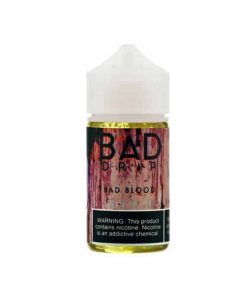

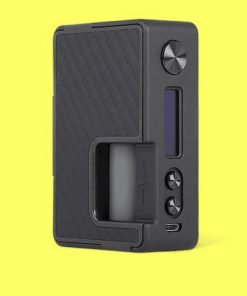

Thuốc lá điện tử

1.400.000₫

580.000₫

450.000₫

580.000₫

290.000₫

300.000₫